Need emergency cash immediately and have bad credit?

In case of an emergency, it's important to have some cash on hand. If you don't have any savings, it can be difficult to come up with the money you need in a hurry.

If you're worried about your credit score, don't worry – there are ways to get cash in a hurry even if you have bad credit.

In this article, we will discuss several options for getting the cash you need in case of an emergency.

1. Payroll advance

You can ask your employer for an advance on your paycheck.

Many employers now offer payroll advances to their employees according to Wall Street Journal,

“A growing number of companies are helping workers gain access to payroll advances and loans, reflecting concern over the impact money problems are having on productivity levels and worker retention.”

My previous company offered it because it helped our employees, and everyone faces emergencies and this is a much better option than a payday loan or an online installment loan and everyone benefits.

If your employer won’t offer a payroll advance, you can try payroll advance apps.

These free mobile applications available in the App Store and Google Play Store can help you get your paycheck early so you can enjoy cash now.

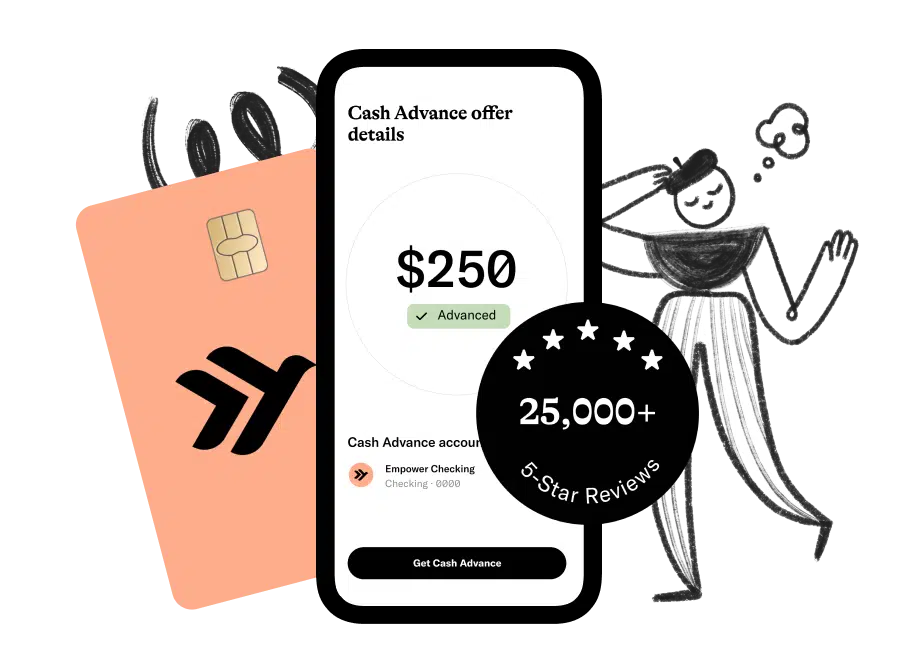

Empower

Empower is an app designed to be a one-stop shop for today’s generation – no matter what the future throws at you, they’ll help guide you. By downloading the app and using it, people can get up to $250 in cash advances when needed, as well as saving for their future.

They’ll provide a cash advance on your next paycheck up to $250 directly to your account. There’s no application or credit check required and there are never any hidden fees, interest rates or credit risk – just pay them back automatically when you receive another direct deposit from your payroll.

You can count on them to have your back and get a cash advance up to $250 directly to your account. No applications, no interest or late fees, no credit checks or credit risk. You just pay them back automatically when you receive your next direct deposit. There’s no catch. It’s that simple.

2. Get a personal loan (even if you have bad credit)

If you actually need money now, then you can opt for a personal loan. When you need money in a hurry ZippyLoan is where to go. You apply for a loan through the Zippy Loan site, if approved they send your loan application to one of many loan providers.

You review the loan details and e-sign if you like what you see. No risk in checking what offers you’ll get. You can borrow between $100 and $15,000 as soon as tomorrow. Loans service for up to 60 months.

ZippyLoan connects borrowers to lenders through their network of lenders. They’ll find you the lowest interest rate and is one of the best no credit check personal loan. You can visit ZippyLoan here.

- Borrow between $100 and $15,000 as soon as tomorrow

- No credit check

- Good option if you have bad credit

3. Credit card cash advance

Another option is to take out a credit card cash advance. You can use your credit card to withdraw money at any ATM, but keep in mind that not all cards are eligible and some will charge you a fee for the privilege.

You could use credit cards that offer this such as:

If you’re desperate enough, though, this might be worth it as long as you can pay the money back quickly.

You should also be aware that withdrawing cash on your credit card will likely result in a higher interest rate being applied to your account, so it’s not ideal if you’re looking for long-term relief.

If you're worried about paying it back, you can find ways to make extra money to pay it back. We have an article on ways to make $200 in a day from scratch.

4. Cash in on unwanted clutter

If you’re in a pinch and need cash quickly, selling unwanted items is a good way to make money fast.

You can host a garage sale or post items for sale on Facebook Marketplace or selling apps.

If you have valuable items, like jewelry or electronics, you could also consider selling them online through eBay or a local pawn shop.

Be sure to do your research so you get the best price for your belongings.

Selling stuff is an easy way to make money, and it's a great option if you need cash in a hurry.

5. Pick up odd jobs or ‘gig’ work

Another way to get cash quickly is by picking up odd jobs or doing ‘gig’ work.

For example, you can make money fast by delivering groceries in the gig economy.

Instacart delivers groceries from local stores in two hours from stores like Whole Foods Market, Target, Costco and Petco. Why should you care? Because this is a lucrative opportunity for you to make money fast.

If you wanted to become an Instacart personal grocery shopper, you’ll earn an average of $15 per hour!

Interested? Sign up as a personal grocery shopper and start to receive grocery orders through an app on your smartphone and then shop and deliver groceries to the customer’s door.

You can start earning quickly and get paid weekly and schedule hours based on your schedule.

6. Use payday loan alternatives

Give yourself a pat on your back if you have avoided a payday loan to this date. But if you haven’t, there are a number of actions you can look for in payday loan alternatives.

Let’s take a look at some suggestions for you if you are trying to break away from an ongoing payday loan debt cycle.

Negotiate with your creditors

All the creditors are not the same. Consequently, everybody in the loan lending business isn’t rude and will hear you out. It’s always nice remembering that there are some nice and polite creditors in this fast-paced capitalistic economy. If you have a temporary hurdle in cash flow, they will definitely understand your condition and will assist you in providing some sort of relief. Discuss your problem with them and ask for an extension in the repayment procedure.

Consider small consolidation loans

There are pawnbrokers or credit unions that can be good options to consider but require long and outdrawn procedures and paperwork. These loans are approved after going through detailed documentation and verification procedures.

Try to make extra income

Ask your employer to work a little longer and earn some extra money by working overtime.

Borrow from friend or relative

If you want to avoid payday loans and the notoriously high interest rates, it’s better to borrow from your friends or family members. Don’t feel embarrassed, share your financial condition with them and the worse they can say is no.

You’ll get through this

There are a number of ways to get cash in case of an emergency. You can use services like Chime, ZippyLoan, or credit card cash advances. You could also sell your belongings, do odd jobs or gig work, or pick up a personal loan, even if you have bad credit. Whatever option you choose, be sure to do your research so you get the best deal possible.

Remember, it's important to have a plan B in case of an emergency. So, if you don't have $500 saved up, don't worry – there are plenty of other ways to get the cash you need.

Related Resources

- How Can I Get a $400 Loan Today?

- Your Ultimate LendJet Review for 2022

- Prosper Loans Review: Is it Legit?