Finding a bank for your small business checking account can be a difficult task. You want an account that will support your business, but sometimes those fees and surcharges can be more of a hassle than they’re worth.

The best bank for business checking should propel you forward, not hold you and your profits back.

If you’re looking for a dependable business checking account for your small business, NorthOne should be at the top of your list. In fact, it’s the center of our conversation in this article, which will also introduce you to the features and benefits of owning a NorthOne Business Banking Account.

By the end of it all, you’ll have a better idea of whether or not NorthOne is the right bank for your small business checking account.

Are you ready to find out if a NorthOne Business Banking Account is right for your company? Let’s get started by learning more about what NorthOne is.

| Monthly fee: | $10 |

| Minimum opening deposit requirement: | $50 |

| APY: | None |

| Transactions: | Unlimited fee-free transactions |

Disclosure: Banks Done Right was compensated for this post. This post also contains affiliate links, and I will be compensated if you make a purchase after clicking on my links.

What is NorthOne?

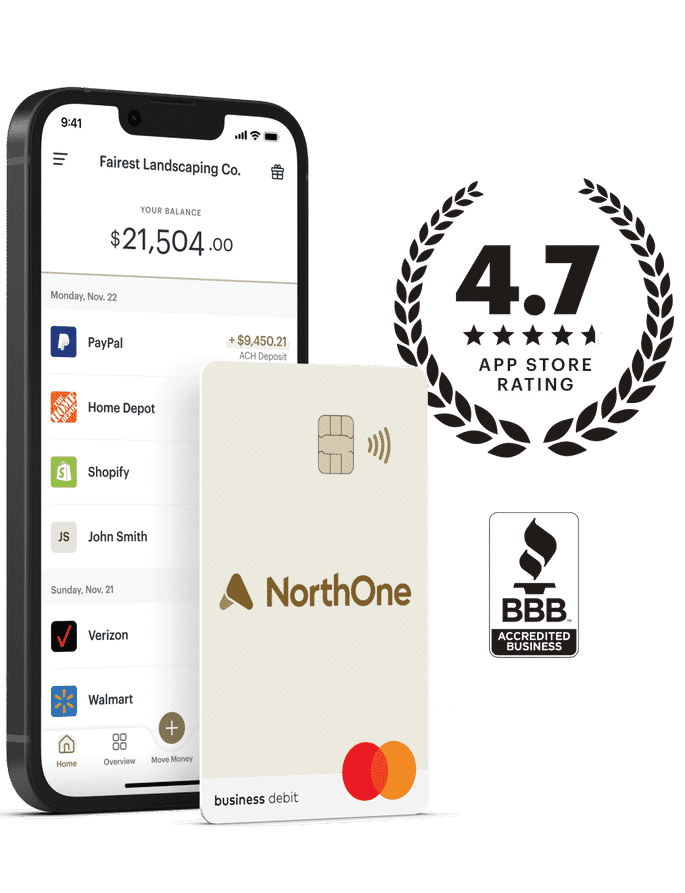

NorthOne is not a bank. In fact, it’s a “financial technology company” that focuses exclusively on small business owners and their needs. Their mission has always been to listen to their customers to bring them a better financial experience.

This includes breaking the mold of a traditional bank by offering services that make sense without the fees that don’t.

To be clear, NorthOne does not offer personal checking accounts. They are solely invested in supporting small business owners by providing banking services that make sense for “the little guy.” In fact, we ranked it as our top pick for the best banks for freelancers.

What Do They Offer?

A relatively new company, NorthOne was established in 2017 but continues to tailor its financial products to the small business owner.

These products include business checking accounts that actually serve to support small businesses as they grow through clear-cut fee structures and unlimited transactions.

Feedback gathered over the course of a year helped the founders of NorthOne to better understand what it is business owners are looking for in a bank in order to create a more fulfilling experience for all involved.

Even though NorthOne may not have any physical branches, they do offer customer service support. With offices in New York, California, and Oregon, help is simply a call or click away.

Let’s take a closer look at the features and benefits of a NorthOne Business Banking Account.

Unlimited Fee-Free Transactions

Besides the $10 monthly maintenance fee, NorthOne offers a slew of free transactions that are practically limitless.

In fact, the only major fee you’ll pay is to complete a domestic wire transfer (incoming and outgoing), and even then it’s only $15.

Overdraft fees, minimum interest fees, and any other non-sufficient fund (NSF) fees are waived for NorthOne account holders.

There are also no fees for making payments, deposits, transfers, purchases, or integrating with third-party apps (more on that below).

Digital Tools

Because NorthOne shed the brick-and-mortar bindings, all your business banking is at your fingertips. Whether you choose to bank via your phone or the web, you can manage your money from wherever you want.

For example, you can easily deposit checks with your smartphone. You can initiate cash withdrawals, too, as well as send and receive ACH and wire payments.

Checking your balance simply requires logging in, so you’ll know what’s going on with your business financially at all times.

Nationwide ATM Access

ATM fees can eat up a lot of your savings if you aren’t careful. That’s why NorthOne works with the Cirrus ATM network. There are over 2 million locations around the country that will allow you to access your NorthOne account without the fear of incurring a pesky ATM fee.

Widespread ATM access can easily save you time and money. Rather than having to drive to a physical branch, you can simply find the nearest Cirrus ATM and do your business there.

This is especially helpful if you are traveling for work and need to withdraw and/or deposit cash right then and there.

Compatible With Multiple Third-Party Apps

Achieving simple processes in a business setting can make everything that much better. After all, streamlining allows for fewer problems to occur (or at least that’s the theory).

NorthOne recognizes the need for keeping your financial records straight, so they’ve integrated their systems with popular accounting software apps.

These include Stripe, Quickbooks, PayPal, Square, and more. Seamless integration means you’ll have more time to spend on other things besides accounting.

Unlimited Budgeting Envelopes

You may have heard of the envelope system, where you place a certain amount of money in an envelope to use for a particular purpose. This system works well for personal budgeting as well as for business budgets.

NorthOne allows you to create as many budgeting Envelopes as you wish. Though they might be digital, they’ll still allow you to stow your money away for a later date. You can even set up programs to automatically save and budget for you to keep your cash flow in the black.

How Does NorthOne Business Checking Work?

Signing up for a NorthOne account doesn’t require a business degree. In fact, you can learn more about how to open a NorthOne Business Banking Account below. It only takes a few minutes and you can be banking within minutes.

The benefits of the NorthOne banking account are many and only come with a $10 monthly fee.

In fact, you can use one of the many Greendot locations around the country to deposit cash, even if you don’t have a Greendot checking account. This can make it easy to fund your account on the go, especially if you travel for your business.

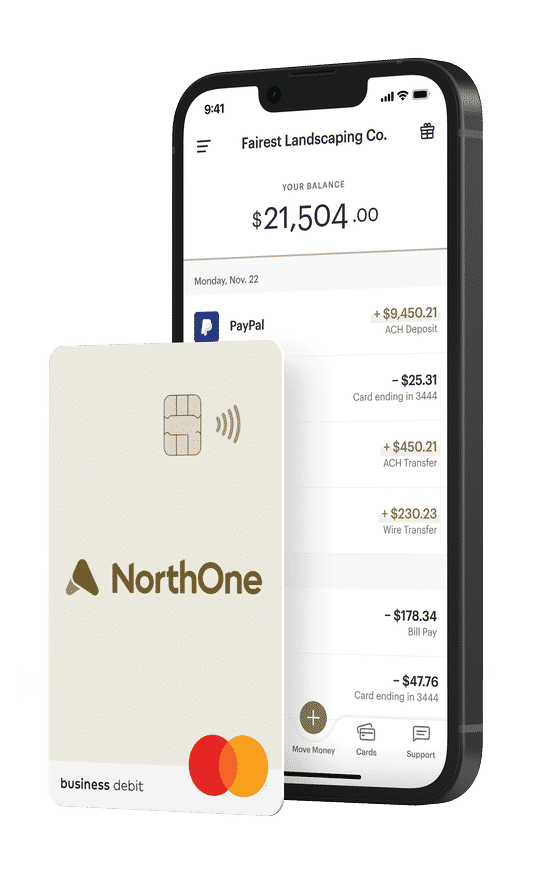

Registering for a NorthOne account also earns you a free Mastercard Small Business Debit Card. This card requires $50 in order to generate your account, but it can be used wherever Mastercard is accepted.

Speaking of which, you can also withdraw and deposit money through the 2 million Cirrus network ATMs without having to worry about hefty ATM fees.

NorthOne also makes moving money around an easy task. Their digital tools allow you to make payments and deposits from your phone, as well as pay invoices directly from your account. Balances up to $250,000 are insured by Bancorp Bank, which is a member of FDIC.

Finally, NorthOne integrates easily with many invoicing applications, such as Quickbooks and Stripe. These systems will do the talking so you don’t have to worry about transposing numbers. Simply link your accounts and keep better track of your funds as you do business.

Pricing/Fees

In order to create your account at NorthOne, you’ll need at least $50 to deposit onto your debit card.

This allows you to begin using it for your business transactions. You’ll also have a monthly maintenance fee of $10 as well.

When it comes to transfers, however, you’ll only pay for domestic wires. Even then, it’s only $15.

However, you will be restricted in terms of daily limits of $10,000 and monthly limits of $300,000.

These same limits apply to ACH transfers, which incur zero fees as long as they fall under the previous limits.

Pros

There are many reasons why your business could benefit from a NorthOne checking account. Here are a few of the main ones:

- Access to over 2 million ATMs across the nation

- Unlimited access to free transactions (except for domestic wire transfers)

- Exclusively mobile so you don’t have to travel to physical branches to get business done

- Integrates seamlessly with third-party accounting applications

- Digital tools to help you manage and save your money

- The referral program allows you to earn $75 for every referral that meets the eligibility criteria, successfully opens an account, and funds their prepaid Mastercard with at least $50

- Personal and financial information under strict security measures, including biometric identification methods

- Federally insured up to $250,000 through Bancorp Bank

Cons

As much as NorthOne does offer small businesses a break when it comes to checking accounts, there are a few areas where they could improve:

- You won’t earn rewards or obtain perks for the money you spend

- $10 monthly fee is more than you might pay for your personal banking account, or a business checking account at another financial institution

- Mastercard prepaid debit card must be loaded with at least $50 but no more than $250 at a time, which can be limiting for some business models

- NorthOne no longer works with Cash App in order to fund your prepaid debit card

- International wires are not supported at this time

How Do I Open An Account?

Opening an account on NorthOne is fairly straightforward and shouldn’t take you more than 10 minutes at the most. You’ll need basic personal information as can be expected when opening a personal checking account.

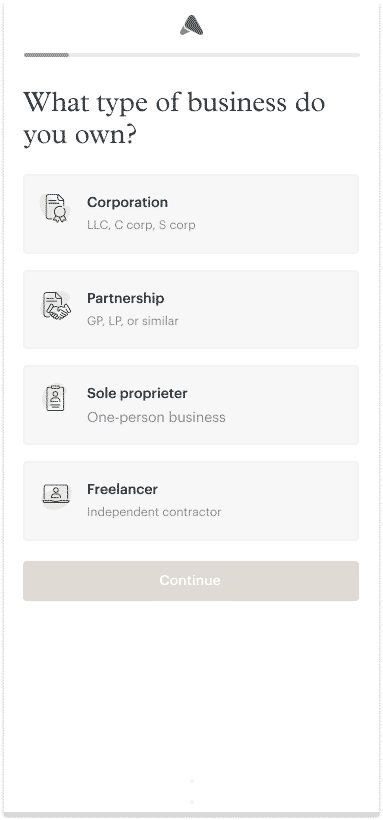

NorthOne allows you to sign up via mobile or the web. The process is the same, except you might see different pictures throughout. The first step is creating a password and linking that to your email address. Then, you’ll need to select what type of business you own.

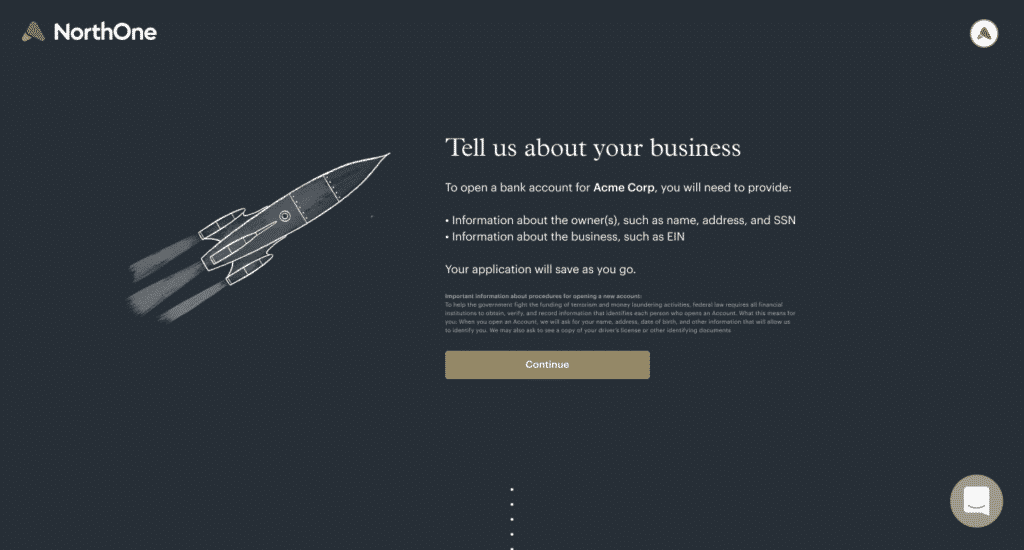

After selecting your business type, you’ll need to provide specific information about that business. This includes the owner’s name and address, their social security number, as well as the business’s EIN (employer identification number).

From there, you’ll choose where you want your new debit card to be sent. Ensure your address is entered correctly.

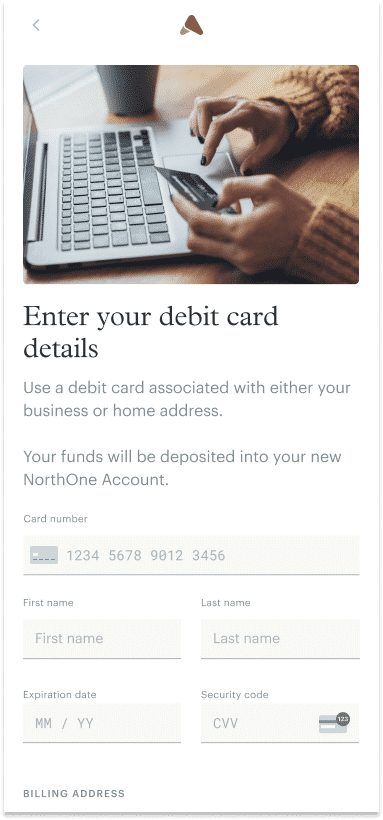

The next screen will prompt you to add funds to your new NorthOne account, which must be at least $50. You’ll do this through an existing debit card by submitting the particulars, such as card number, expiration date, and security code.

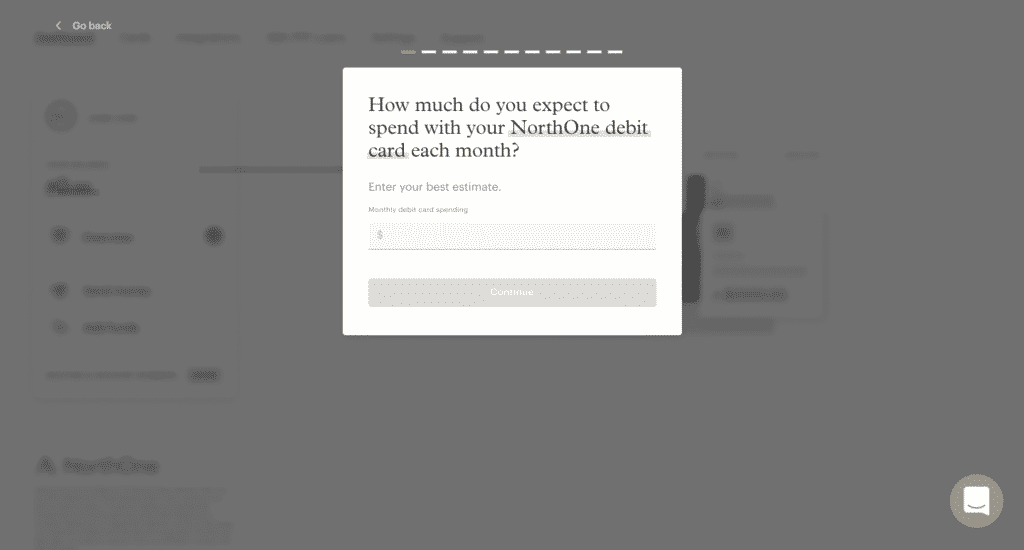

The final screen will ask you how much you plan on spending with your new NorthOne debit card. This won’t necessarily affect your ability to sign up for an account, and is likely just a way for NorthOne to gauge how much their customers will use their new debit cards.

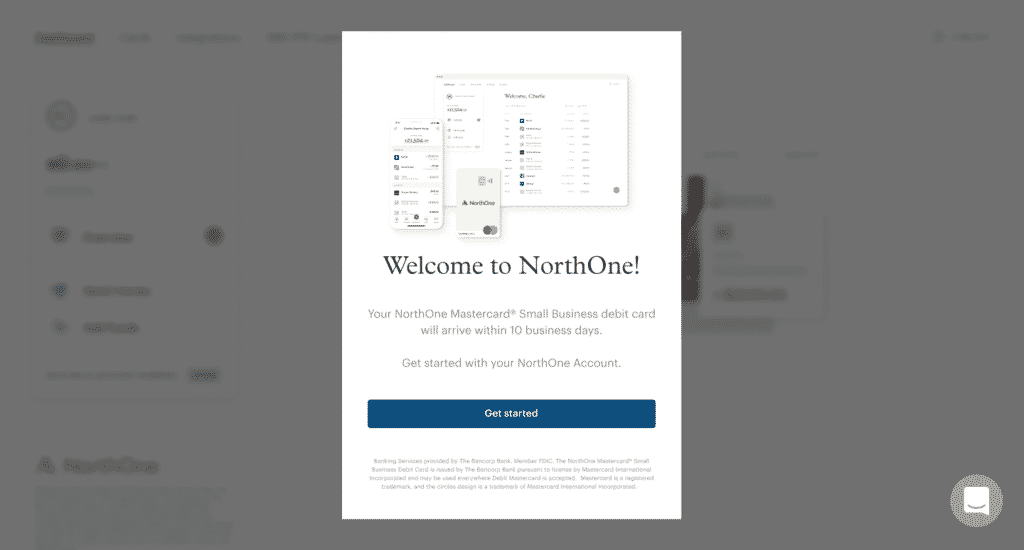

Success! Your new NorthOne business checking account has been created.

You can expect your new NorthOne Mastercard to arrive in the mail within 10 business days after signing up.

Is It Safe And Secure?

NorthOne takes their security, as well as your private information, very seriously. In fact, they’re equipped to support biometric security measures, such as touch or face identification. That’s just the tip of the iceberg when it comes to keeping your financial information secure.

Signing up for a Business Banking Account with NorthOne will not affect your credit score. You will need to enter your personal information, as you witnessed above, but that information is never stored or maintained within NorthOne databases.

There are also identification verification measures in place along the way in order to prevent your information from getting to the wrong people.

NorthOne also monitors your account in case of suspicious activity. Just like your personal bank might do, they’ll notify you if they think there’s an issue so you can take swift action.

In the event your debit card is lost or stolen, you can also lock it and request a new card in seconds to replace it.

FAQs

Yes, NorthOne is an FDIC-insured bank that’s been operating since 2017.

Yes. You can legitimately open a NorthOne Business Banking Account and use it for your business expenses.

NorthOne requires a $50 transfer in order to fund the Mastercard debit card issued after opening an account. Domestic wires are $15 each, and there is a $10 monthly maintenance fee. However, there are no fees or limitations on certain transactions, which allows you the freedom to operate your business without worrying about paying extra.

No, NorthOne is a financial institution that issues Mastercard prepaid debit cards for clients who open a business checking account.

Is It Worth It?

Opening a business checking account with NorthOne can definitely be worth it if you’re looking for a way to keep your personal and business checking accounts separate.

Though you may not be earning any points or rewards from spending money with the NorthOne Mastercard, it’s easy to track spending each time you load the card up.

Plus, there’s no long list of fees to trip you up and take money out of your business profits.