- Minimum age: None

- Monthly fee: $5-$10 per month, up to 5 children

- Free trial: 1 month

- ATM fee: None

- Purchase fees: None

A kids debit card is designed for kids under 18 years old and works just like a regular debit card. There are various financial service providers that provide debit cards for kids, along with accompanying financial learning apps — to allow your kids to learn about how to manage their money from an early age.

Parents can choose to be as involved as they like in the financial learning process with these types of cards. Parents have the ability to monitor kids’ financial activities with their debit cards, as their accounts will get connected with your accounts. There are also various fun financial learning tools you can use together with your kids to build better financial habits for them.

In this guide, we will talk about 4 popular financial service providers that offer debit cards for kids today, which are Greenlight, GoHenry, BusyKid, and FamZoo. Let’s dive deeper into it.

This article was reviewed by Brian Meiggs, who has been cited as a personal finance expert on publications such as Insider, Discover, and Yahoo! Finance.

The Best Debit Cards for Kids

- Minimum age: None

- Monthly fee: $5-$10 per month, up to 5 children

- Free trial: 1 month

- ATM fee: None

- Purchase fees: None

- Minimum age: 6

- Monthly fee: $4 per child

- Free trial: 1 month

- ATM fee: $1.50 per transaction

- Purchase fees: None

- Minimum age: None

- Monthly fee: $1.67 per month, unlimited children

- Free trial: 1 month

- ATM fee: None

- Purchase fees: None

- Minimum age: None

- Monthly fee: $5.99 per child

- Free trial: 1 month

- ATM fee: None

- Purchase fees: None

Overview of Greenlight

Greenlight provides debit cards for kids, teens, and grownups, along with the banking and investing app that can help kids learn how to save and manage their money. With

Greenlight, parents can teach their kids to manage their money well, create good financial habits, and teach them how to save and invest their money.

The app offers various financial tools that can give your kids the ways to learn how to manage their finances while keeping it fun for them.

Features:

- Greenlight provides personalized debit cards for your kids with their selfie on the card, so they can manage their finances with more confidence.

- You can create chores from within the app and let your kids complete them, and you can also set their allowance on autopilot, whether per week or per month.

- You will get real-time notifications every time your kids use their debit cards, and you can also send money to your kids’ debit card accounts anytime and anywhere.

Sign up: Greenlight

- Minimum age: None

- Monthly fee: $5-$10 per month, up to 5 children

- Free trial: 1 month

- ATM fee: None

- Purchase fees: None

Overview of GoHenry

GoHenry offers debit cards for kids aged 6-18, allowing them to become more aware of their finances.

With GoHenry debit cards, you can teach your kids about how to manage their finances, so that they can feel more confident in handling their everyday money matters, such as savings and spending.

It also comes with the financial learning app with various tools your kids can use to help manage their money better.

Features:

- Your kids can use money missions on the GoHenry app to help them build better financial habits, while staying motivated when they do so.

- The financial app from GoHenry can teach your kids about how to reach their own financial independence by learning how to budget, how to differentiate between wants and needs, how to save, how to invest, and so on. You will also get updates on how your kids manage their money, with real-time notifications.

- Other features you can use from GoHenry include customizable debit cards, allowance on repeat, set tasks for your kids and get them paid when they do it, spending controls, and real-time updates. The debit card also comes with the Zero Liability Protection and $250,000 FDIC insurance.

Sign up: GoHenry

- Minimum age: 6

- Monthly fee: $4 per child

- Free trial: 1 month

- ATM fee: $1.50 per transaction

- Purchase fees: None

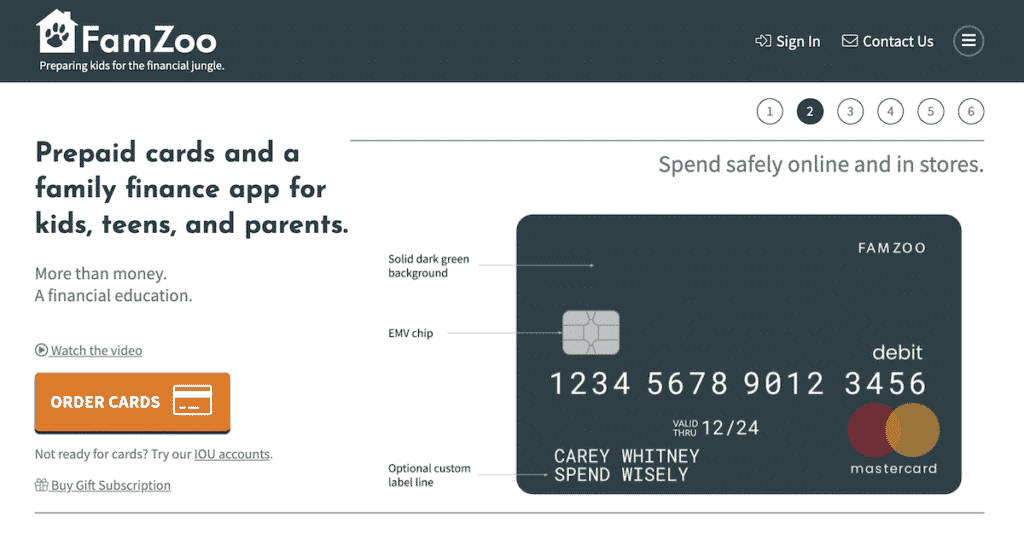

Overview of FamZoo

FamZoo provides prepaid debit cards for kids, teens, and parents, and it also includes a financial app that allows the whole family members to learn about how to manage their money better.

With FamZoo, parents can educate their kids about how to spend, save, invest, and manage their money, so they can build better financial habits.

The financial app from FamZoo can also give them the tools to help your kids build their own financial freedom when they reach adulthood.

Features:

- With FamZoo, you can teach your kids to take responsibility for their finances, and you can also help create budgets for your kids, create incentives for their money, and evaluate their progress on the app.

- You don’t need to have a bank account to use the debit cards from FamZoo, as you can reload the funds on your FamZoo debit cards through certain government agencies or certain retailers. However, having a bank account with FamZoo will make everything simpler for you to manage your accounts.

- FamZoo offers various features designed to help your whole family members be more aware of their finances, including automated allowance, chore review option, automated family billing, family loan tracking, direct deposit for teens, card activity alerts, detailed decline info, restricted child access, and more.

Sign up: FamZoo

- Minimum age: None

- Monthly fee: $5.99 per child

- Free trial: 1 month

- ATM fee: None

- Purchase fees: None

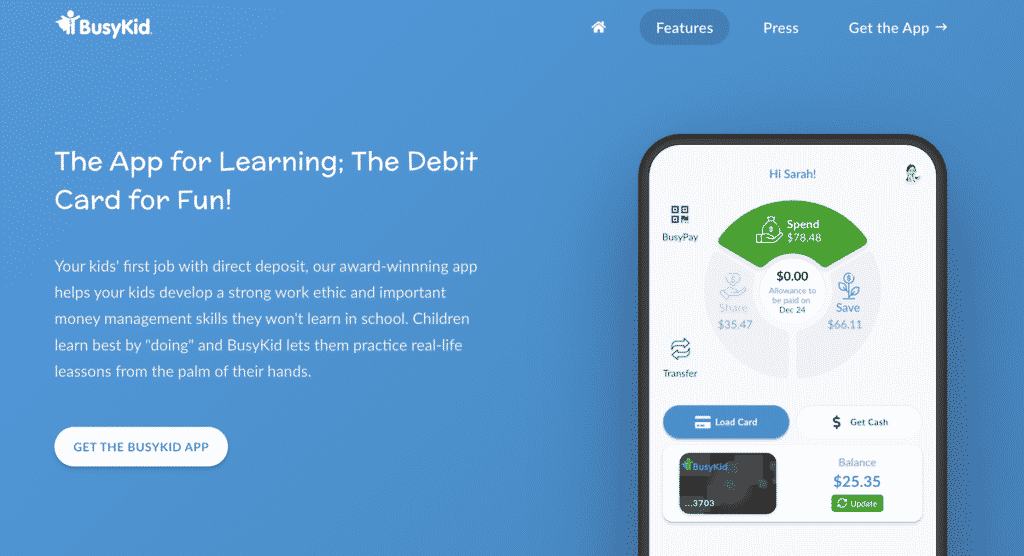

Overview of BusyKid

BusyKid provides a chore app for kids that will help parents teach the value of money in their kids’ life.

It also comes with the prepaid debit cards your kids can use to spend their money after completing your chores.

The BusyKid app can help your kids learn how to earn money, how to manage their money, and how to save their money.

Their debit cards will get connected to your account, so you can send money to your kids whenever they complete their chores.

Features:

- With BusyKid, your kids can earn money by completing the chores or tasks you set, such as finishing laundry, cleaning the house, and so on. You can send money to your kids right away after they complete their chores for the day.

- There are four ways for your kids to manage their money with BusyKid, which include Earn, Save, Spend, and Donate. The app will teach your kids to manage their money, and you will also monitor their progress along the way.

- BusyKid offers prepaid debit cards for your kids, which they can use to spend their money. Your kids can use the prepaid debit cards in various merchants, both online and offline. You will get notified every time your kids spend some money on their prepaid debit cards, so you can always get informed about their financial activities.

Sign up: BusyKid

- Minimum age: None

- Monthly fee: $1.67 per month, unlimited children

- Free trial: 1 month

- ATM fee: None

- Purchase fees: None

Greenlight vs. GoHenry vs. BusyKid vs. FamZoo: Which is Best?

These are the debit cards for kids you can use today. You can use these debit cards along with the accompanying apps to help your kids learn about how to manage their money, so they can build better financial habits for their future. As their parents, you can also monitor all their financial activities from your app interface, so you can always follow their progress.

Now, which debit card for kids is best for you to use? Let’s dive deeper to find the best debit card for kids you can use.

Best for Fees

Now, we are talking about the fees these debit cards offer for you. Here are the fees you need to pay for each debit card for kids:

- Greenlight. Greenlight offers 3 subscription plans, which are Greenlight, Greenlight + Invest, and Greenlight Max. The Greenlight plan goes for $4.99/month, the Greenlight + Invest plan goes for $7.98/month, and the Greenlight Max plan goes for $9.98/month.

- GoHenry. GoHenry offers an affordable pricing of $3.99/month per card, with the first month free.

- FamZoo. FamZoo also offers an affordable family plan, which is $5.99/month. You can also pay per 6 months, per year, or per 24 months, which will give you a cheaper fee per month.

- BusyKid. BusyKid offers a $3.99/month subscription plan, with a cheaper annual subscription plan option available.

So, which one will you choose? When taking fees into consideration, GoHenry is the best way to go if you are looking for an affordable debit card for kids. GoHenry gives you the affordable $3.99/month plan for your kids, along with a 1-month free trial. It means you will get the best value out of your investment in this debit card for kids.

- Minimum age: 6

- Monthly fee: $4 per child

- Free trial: 1 month

- ATM fee: $1.50 per transaction

- Purchase fees: None

Best for Learning

Between Greenlight, GoHenry, FamZoo, and BusyKid, they offer the same type of financial learning tools for your kids. These financial learning tools can help your kids understand more about the value of money in their life and to help them manage their money better. There are various ways your kids can learn about financial management with these apps, which can pave their way to understand more about how to manage their finances when they reach adulthood.

Which one of these debit cards for kids is best for learning? The one which offers you the best learning features is FamZoo. FamZoo provides integrated financial learning tools between parents and kids, so you can connect with your kids’ accounts with ease. Also, with FamZoo, you can monitor and control the way your kids use their money through the app.

It provides conveniences for parents to help their kids understand more about money while keeping in control of their account access. The best learning features your kids can use in FamZoo include payment checklists, spending and saving, payment splits, parent-paid interest, savings goals, family billing, and informal loan tracking.

- Minimum age: None

- Monthly fee: $5.99 per child

- Free trial: 1 month

- ATM fee: None

- Purchase fees: None

Best Overall

Considering the overall value you will get from these debit cards for kids, which one should you choose? Between Greenlight, GoHenry, BusyKid, and FamZoo, all services offer the affordable subscription plan per month, and they also offer apps you can use to help teach your kids about how to handle their finances. However, among all these options, Greenlight offers the best overall value for parents, as this platform offers both affordable pricing and feature-rich financial learning apps for kids.

Greenlight provides debit cards for kids and financial learning apps that cover basic money management education for kids, as well as a wealth of features for parents to help follow their kids’ progress. Not only that, but Greenlight also provides a 1% savings reward for the savings your kids put on their accounts. You can even get a 2% savings reward if you subscribe to the Greenlight Max plan.

Also, Greenlight provides various security features that ensure your kids’ debit cards security, such as purchase protection, identity theft protection, cell phone protection, and more. So, it is the right platform to use if you want to give your kids a complete learning experience in their financial management.

- Minimum age: None

- Monthly fee: $5-$10 per month, up to 5 children

- Free trial: 1 month

- ATM fee: None

- Purchase fees: None

Are Debit Cards for Kids Safe?

The answer is yes, debit cards for kids are secure to use. We have provided you with a comparison of the most popular ones you can use today, which are Greenlight, GoHenry, BusyKid, and FamZoo. These service providers offer various security and privacy features for the debit cards for kids they release. So, you don’t need to worry about the privacy and security of these debit cards. Also, there are other reasons that ensure the safety of these debit cards for kids:

- The parents get full control of their kids’ accounts. The parental control settings allow the parents to set various options, limits, and boundaries that their kids can access on their accounts. For instance, you can limit your kids’ spending to a certain amount per week, restrict transactions in certain merchants, and so on.

- Various transaction protections are in place. The debit cards for kids provide various protections for each transaction your kids make with their debit cards. These protections include identity theft protection, purchase protection, cell phone protection, PIN protection, and so on.

- Instant notifications for the parents. Whenever your kids spend their money on their accounts, you will get notifications in real time. So, you always know the money your kids are spending every time they do it. You will also know how your kids invest, save, and manage their money on their accounts.

- FDIC insurance. Each account has FDIC insurance for up to $250,000, so your funds are secure with these financial service providers. You don’t need to worry about sending money to your kids’ accounts, and you don’t need to worry about their account security.

- Debit card security. The debit cards released by these financial service providers also have various layers of security that allow your kids to secure their transactions with any merchants. It has the chip and PIN technology to add extra layers of security to the debit cards.

FAQs

- How can I set expectations with my child? It’s best for you to set clear boundaries with your kids about the purpose of giving them the debit cards for kids. You also need to find out about what you can expect from the financial app that comes with the debit cards, so you will know what features you can use, how you can control your child’s accounts, how to use the app in the right way, and so on.

- How do I learn what the company is doing with my child's information? You can find out about the company’s privacy policy in their official URL. All the companies we provide in this guide are legit companies that will keep all your data, along with your kids’ data, confidential, secure, and private.

- How can I tell whether my child's personal data is compromised? Their data will remain safe as long as you teach your kids to keep their account and debit card information confidential. However, you can always monitor the use of your kids’ debit cards to determine if they keep their personal data secure and private. You should report any suspicious activity to the financial service provider right away.

- What if I still have questions? You can get in touch with the customer service department of Greenlight, GoHenry, BusyKid, or FamZoo, depending on which service you are using.

Conclusion

You have learned about Greenlight, GoHenry, BusyKid, and FamZoo debit cards for kids. We recommend you to use Greenlight if you want to give the full financial learning experience for your kids, and best of all, they also offer affordable subscription plans you can choose.

It’s always best to teach your kids about how to manage their money as early as possible, so they can build positive financial habits when they grow up toward adulthood. A good financial habit can set them to reach their financial freedom in the future. As their parents, it’s always a good thing for you to provide the best financial education for your kids with the use of debit cards for kids.

- Minimum age: None

- Monthly fee: $5-$10 per month, up to 5 children

- Free trial: 1 month

- ATM fee: None

- Purchase fees: None